Big Companies Can Benefit as Small DTC Brands Show Pathways for Growth

- POV’s

- April 1, 2019

- Brian Wieser

It has long seemed evident that the rise of the internet made it increasingly possible for small businesses to challenge large ones, destroying obstacles of geographic distance and the ease of product awareness through digital advertising. In the marketing world this seemingly manifests itself in the rise of directto-consumer brands, which appear to be threatening giant incumbents in many industries. But is disruption of this nature really happening?

While it may very well reflect reality in certain sectors, a review of recent data from within the United States focusing on US Census Bureau and Bureau of Labor Statistics data indicates that it is most definitively not happening across the broader economy, at least not yet.

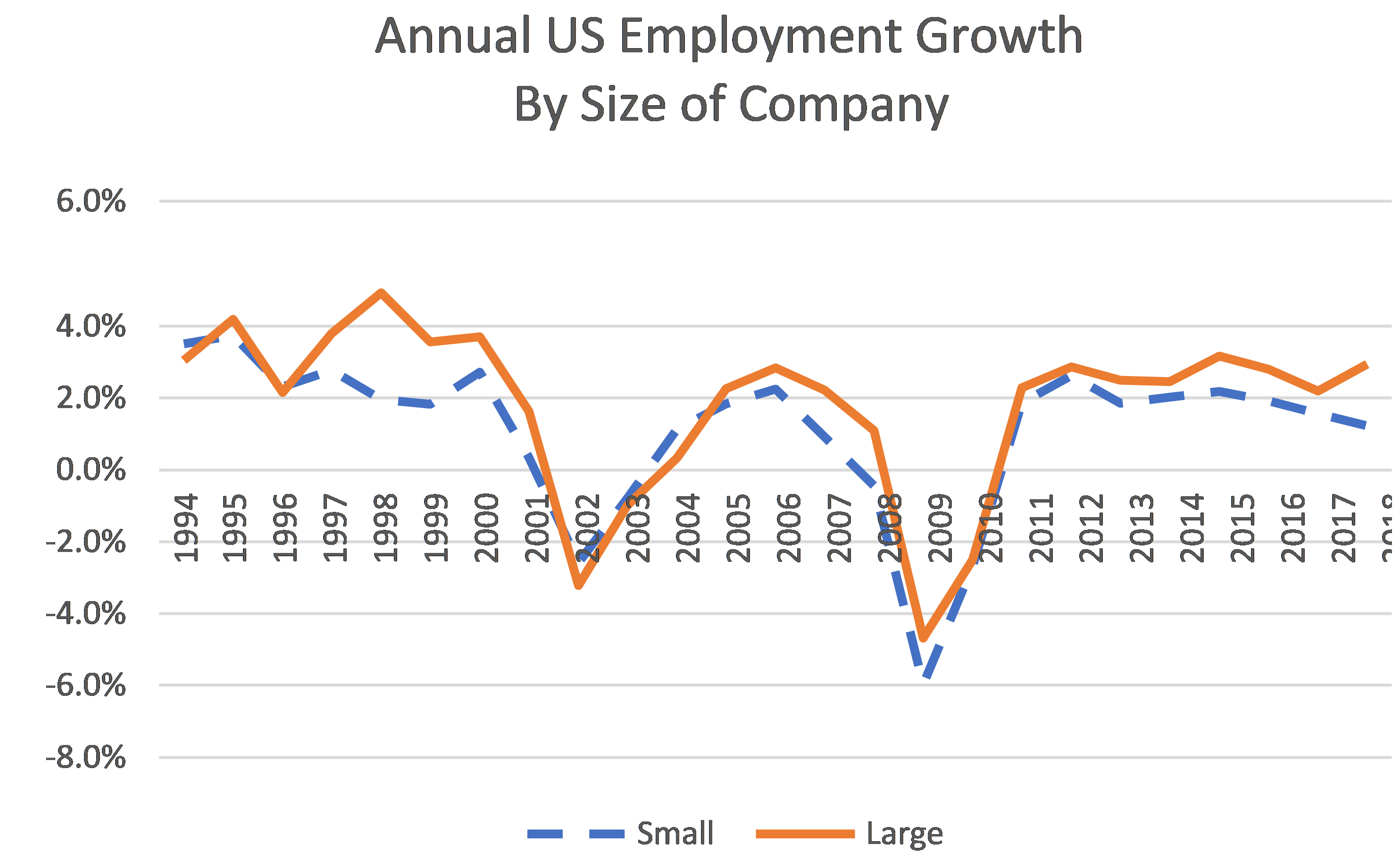

The data shows conclusively that over any extended period of time, companies with more than 1000 employees have grown much faster than companies with fewer than 1000 employees. In fact, the growth gap actually widened in 2018 over 2017.

To illustrate further, 25 years ago the smaller cohort of companies accounted for 59% of employment. It has fallen steadily over time to account for 55% of employment as of 2018. Put differently, employment at small companies has risen by a compounded annual growth rate (CAGR) of +1.1% over 25 years while employment at larger ones has risen by +1.8%. Similar growth gaps are evident over different time frames as well. To the extent that employment, payroll spending and revenue vary by size of company and generally track over time (and data from Census indicates it does, at least through the period for which comparable data is available through 2012), we can conclude that big businesses are probably getting bigger and gaining market share rather than losing share to upstarts.

While not all DTC companies are small, few of the companies which have emerged have exceeded a 1,000 employee threshold. Arguably, it is equally – if not more – accurate to think of emerging DTC businesses as the form that small business increasingly takes. It’s not yet clear that many of them will become giant killers and collectively take share from a given industry’s largest companies. Of course, it’s certainly true that many DTC businesses are growing rapidly and that some will become giants themselves. However, most will probably remain small as is true for other types of businesses. Recent weakness at large incumbent brand owners may be explained to some degree by the rise of DTC brands, but is likely better explained by competition from retailers’ house brands, changing power dynamics with those retailers on other fronts as well as broader changes in consumer preferences and spending priorities.

This doesn’t take away from the important lessons that DTC businesses offer companies across all sectors of the economy. Business processes embraced by small businesses are important for large ones to explore, including their entrepreneurial approaches to “growth hacking”, the establishment of data assets, the focus from many of them on customer acquisition costs and lifetime value as well as the establishment of subscription-based revenue models. All of these capabilities will be increasingly important for businesses of all sizes to embrace on an ongoing basis in years ahead.