Implications of Economic Deceleration for Advertisers

- POV’s

- September 3, 2019

- Brian Wieser

Key Takeaways:

- Economic growth is decelerating in most countries

- Advertising growth is also looking neutral to negative vs. last year’s levels, with recent trends likely to continue

- Marketers can prepare for opportunities which can emerge in a downturn

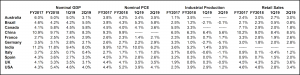

Fragile global economy shows mild fractures. Concerns have risen around the health of the global economy since we published the mid-year update to our global advertising forecasts at the beginning of June. At the time, we referenced the OECD’s then-recent assessment of the global economy as “fragile,” acknowledging economic growth alongside increasing risks that we might begin to see meaningful deceleration. Since then, most of the world’s major economies have published estimates of economic growth for the second quarter. Along with GDP (the broadest measure of economic growth in a country), we have also wanted to look at current trends in personal consumption expenditures (PCE, usually the majority of a country’s GDP, and often more tightly correlated with advertising than GDP), retail sales and industrial production (each of which can correlate more highly with advertising than either GDP or PCE). All metrics have been tracked here in current/nominal terms, meaning not discounted for inflation, and on a non-seasonally adjusted basis when available.

Year-over-year growth trends for some key economic variables so far in 2019 are generally negative. For the countries we looked at in recent weeks, if we compare second quarter conditions with those for all of 2018, we see GDP and PCE trends that are generally the same or negative. That is to indicate that we still see growth, but growth which is generally slower than previously observed. However, retail sales and industrial production appear more unambiguously negative versus last year’s levels. Again, these variables tend to be more tightly correlated with advertising because marketers spend on advertising in alignment with the pace at which they make things or sell things.

Advertising growth is looking neutral to negative versus last year, with recent trends likely to continue. This data is consistent with expectations of neutral to negative trends for advertising around the world. While the U.S. saw accelerated advertising growth in the second quarter, this followed a relatively weaker first quarter. In many other countries, deceleration appears to be more pronounced, as indicated in the table above. Further deterioration is likely given the pressures of trade wars – which are likely to persist – alongside Brexit uncertainties impacting both the UK and Europe. All of this says that marketers need to be prepared for a downturn.

Marketers can still look for opportunities in a downturn. In a full economic downturn, advertising growth will generally decline, but not necessarily in every country nor in every medium. This can present opportunities. As we have written previously, global markers with flexibility to shift marketing budgets across countries may find opportunities to redeploy resources from countries with weak economies and strong media markets to those with relatively stronger economies and weaker media markets, as marketing dollars may go further in those instances. More generally, as we can anticipate that most marketers will cut their spending, marketers with the flexibility to do so could benefit from maintaining or increasing spending given the relatively inexpensive opportunities to raise “share-of-voice” that would exist under these circumstances. An economic downturn environment may, in fact, provide marketers and opportunity to grab greater share.

Consumer behaviors could change in response to economic weakness and, as always, require ongoing monitoring. In some instances, we will see shifts in consumer behaviors, but the direction may be hard to anticipate. For example, SVOD services might appear to be discretionary choices that consumers could eliminate in belt tightening. But on the other hand, the relative value of these services versus more expensive entertainment options like theatrical movies, concerts, and more could actually reinforce consumer interest in SVOD which, could be viewed favorably versus the cost of traditional pay TV services. There is no history to point to in terms of predicting how new platforms will fare in a downturn, and so close monitoring of consumer adoption will be increasingly important.

Marketing messages need to maintain relevance. There are, of course, brand-related considerations to consider as well. Marketing messages may need to be adapted in many instances – for example, emphasizing a product’s value or how it helps a consumer avoid incurring other costs. In other instances, marketers may find totally new business opportunities as consumers reassess their spending patterns and product preferences.

“Never let a crisis go to waste.” Choices made under severe economic pressure have the potential to lead to better marketing choices. With the budget cuts that can follow if a company’s revenues fall, some marketers may find themselves forced to be creative in how they deploy resources. If they aren’t doing so already, they should be prepared to assess their mix of spending across marketing services, software and media. For example, some will find investments in marketing technology or other brand experiences prove more effective uses of budgets versus media, especially if they help deepen consumer engagement, enhance “share of wallet,” or reduce customer churn.

Everyone would rather see sustainable growth for their businesses and the economies in which they operate. However, to assume this may occur uninterrupted over the next couple of years requires excessive optimism. Hoping for the best but preparing for the worst will help you survive and thrive over quarters and years to come.